The Link Between Decision-Making and Investment Returns

It exists — we just proved it.

The 2023 Behavioral Alpha Award: Winners & Highlights

New Top 5 announced in industry’s leading skill-based portfolio manager ranking.

The Behavioral Alpha Benchmark: Q3 2023 Rankings

Top portfolio managers extend win streak, consistent with new research into the persistence of investment skill.

The Continuity of Investment Decision-Making Skill

Unlike past portfolio performance, this measure of investment decision-making skill exhibits a statistically-significant relationship into the future.

The Behavioral Alpha Benchmark: Q2 2023 Rankings

Latest results suggest that portfolio manager investment skill persists over time.

The Problem With Performance Attribution

It’s the standard for reporting, but when it comes to identifying actual decision-making skill — whether you’re a portfolio manager or an allocator of capital — performance attribution leaves a lot to be desired. But there’s an alternative: decision attribution.

The Behavioral Alpha Benchmark: Q1 2023 Rankings

New assessment shows sharp increase in active portfolio managers who added value through their decision-making.

Full Transparency Is a Must in This Market

In today’s market environment, investors are seeking openness and a thoughtful plan for future improvement — not past perfection.

Presenting Your Strengths in a Weak Market

How do you show investors your prudence and discipline in managing their capital when your performance-based metrics don’t tell a great story?

The 2022 Behavioral Alpha Award: Winners & Highlights

These five equity portfolio managers demonstrated exceptional skill in a challenging year.

On Decision Attribution and Déjà Vu

When the market tide goes out, investment managers must rely on true investment skill, rather than general buoyancy, to keep them afloat. The question is (and has always been) how.

The Power of Payoff

Payoff: The investment skill metric that separates the best investors from the rest.

The Behavioral Alpha Benchmark and the Active-Passive Debate

Active managers are still very much at play in today’s market, and recent findings show that the skilled ones can outperform their indexes.

Introducing the Behavioral Alpha Benchmark

It’s time to consider the quality of a portfolio manager’s decisions — not just near-term performance.

Can Traditional Active Fund Management Be Saved?

Active managers need to start incorporating the lessons of behavioral science if they have a chance of reversing the flow of assets into passive investment vehicles.

The Essential Summer Reading List

We've updated our popular guide to behavioral science literature, adding some exciting new titles, handy subject categories, and the pick of our team's favorite reads. Happy reading!

Managing Your Mental Game in a Volatile Market

Times like these are when it’s both most important and most difficult to make deliberate, mindful decisions. These leading investment coaches have some suggestions.

Long Term Doesn’t Mean Forever

In my last blog post, I mentioned an objection we often hear from managers who are reticent about working with Essentia: “I’m afraid it will mess with my process”. This post offers a real-life example.

Mess With Your Process, Not Your Philosophy

“I’m afraid of messing with my process. It might make me worse” - this is one of the most common objections we hear at Essentia.

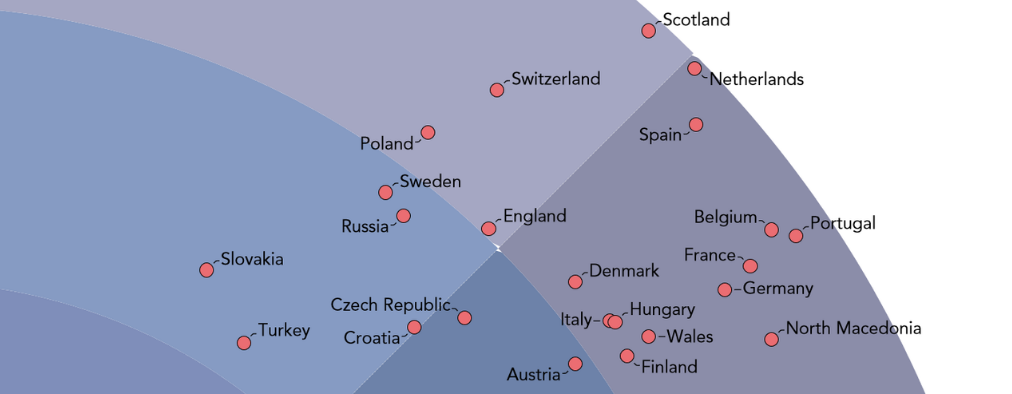

Euro 2020 on the Behavioral Alpha Frontier

The proprietary analysis we use with professional investors suggests some dark horses to watch in this year’s tournament.

NBAlpha: Basketball Behavioral Analytics

We often talk about using sports-style data analytics to optimize investor behavior. We decided to apply our award-winning investment analytics to the NBA finals.

What’s in a Nudge

We examined our database of real-world portfolio manager behavior and found that managers who engage with nudges, on average, significantly outperform those who do not.

Between Mindfulness and a Nudge

Academic research by shows that mindfulness reduces cognitive bias -- people are more rational when they become aware of what they don’t know, get comfortable with uncertainty, and recognize multiple perspectives. We have observed a similar effect among our clients.

Our behavioral science reading list just got even better

We've updated our popular guide to behavioral science literature, adding some exciting new titles, handy subject categories, and the pick of our team's favorite reads. Happy reading!

Tips, Gifts and Tools for WFH Success in 2021

Working from home (WFH) looks to remain an important feature of our future lives. So, to keep you performing at your best in the New Year, we present ten tried-and-tested ideas for acing the challenges that remote working can bring.

Measurably Better – A New Behavioral Analytics Case Study

Our latest case study shows how the managers of a concentrated, low turnover equity fund were able to unlock over 4% of incremental alpha per year by using Essentia’s behavioral analysis, tailored nudges and expert coaching.

Where Alpha Is Lost and Found

Alpha is the holy grail of active portfolio management but its source has always been elusive - until now. In their latest analysis, our research team break new ground by identifying the factors most commonly associated with alpha generation (and destruction) by equity fund managers.

5 Ways to Stick to Your Investment Process

In difficult market conditions, it’s critical that active investors adhere to their established investment processes. Here are five simple but effective actions that can be used to support and strengthen daily decision-making discipline.

7 Tips for Decision-Making Resilience in a COVID-19 World

The coronavirus pandemic poses new challenges to the way we manage ourselves and perform. We talk to seven top investment coaches about how to keep making good portfolio decisions in a disruptive and turbulent environment.

Coronabias and the Fat Tail

In judging other people’s reaction to the coronavirus, are we in danger of displaying a new kind of “coronabias”? Philip Maymin explores this and the wider implications for investor behavior in the current crisis.

What We’re Reading – Updated!

We've updated our popular guide to behavioral science literature, The Essentia Reading List. One of our most downloaded white papers, this comprehensive list includes must-read behavioral classics and some exciting new titles.

Essentia’s 12 Quotes of Christmas

Το celebrate this year’s holiday season, here are 12 pieces of timeless wisdom for your investment decision-making in 2020 and beyond.

The Half-Full Glass: Active Managers CAN Outperform Index Funds, Net of Fees

In a supplement to our Alpha Lifecycle research, we find that disciplined active managers who are able to exit positions at or near the peak of their alpha curve can preserve more than 120 bps outperformance (net of fees), per year, vs index funds.

From Texas Hold’em to Performance Coach: An Interview with Poker Pro Chris Sparks

Essentia CEO Clare Flynn Levy talks to former top-20 online poker player (and Behavioral Alpha Poker Night host) Chris Sparks about the lessons investment professionals can learn from elite-level poker.

The Consequences of Normalized Deviance

Ignoring standard procedure can be disastrous in complex, dynamic sectors like aviation and finance. Clare Flynn Levy considers the presence of normalized deviance in asset management and provides a list of steps to identify and overcome the ways it may already be affecting your investment team.

Don’t Ride a Falling Star

How did the Neil Woodford fund saga become so dramatic - and so destructive? Clare Flynn levy looks beyond traditional risk attribution and style-drift warning signals to explore how unchecked biases brought down this star manager.

Our New Analysis Demonstrates Alpha Lifecycle

We have long suspected that alpha, a key measure of an investment manager's added value, has a finite life span and often tends to decay over time. Our new research proves it, bringing new insights into the nature of alpha and how portfolio managers can act to sustain it.

Two Questions for Noted Cognitive Neuroscientist Tali Sharot

Ahead of her keynote presentation at this year's Behavioral Alpha conference in London, we talk to Dr. Tali Sharot, Professor of Cognitive Neuroscience at UCL and best-selling author, about the factors that can make us change our minds.

Why Investors Tell Themselves Stories

How do investors cut through the huge complexity and uncertainty involved in investment decision-making? Guest blogger Joe Wiggins explores the important role played by story-telling in helping portfolio managers to organise and make sense of the information available.

The right way for investors to use machine learning

Fund managers need to think outside the machine learning "black box" if they want to get the most from this powerful advance in analytical capability. Market data is simply too complex and noisy for the kind of predictive big data being used in other sectors.

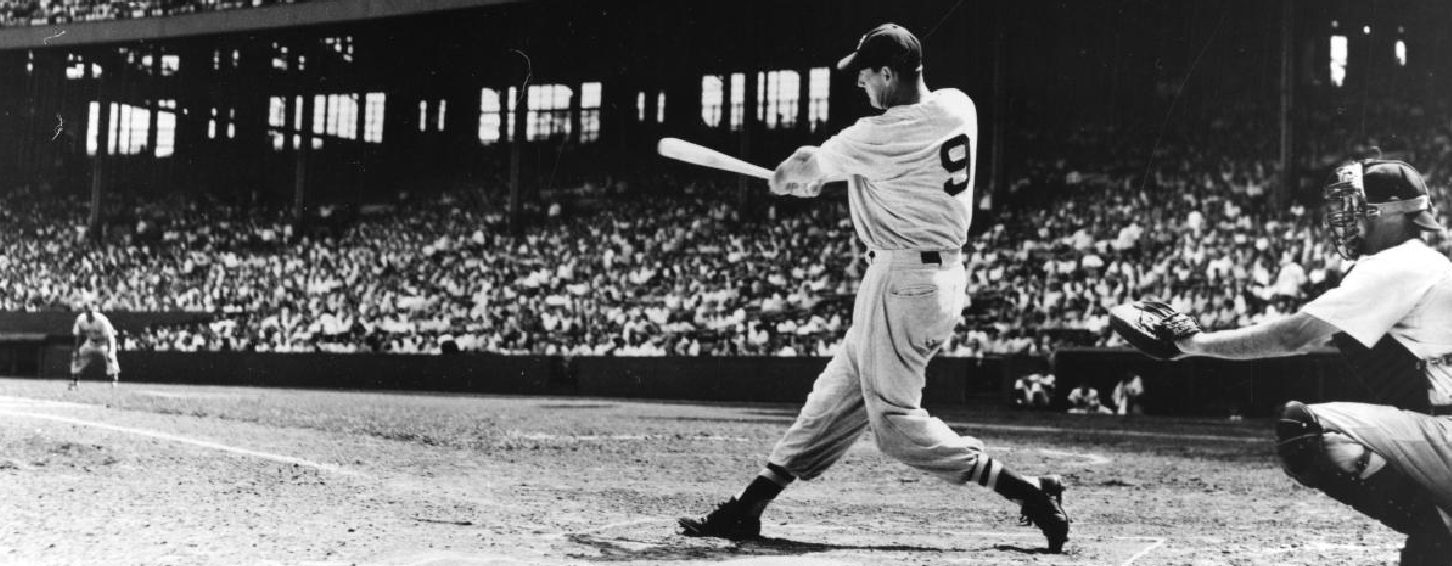

Ted Williams’ Great Lessons for Investors

Arguably the greatest hitter known to baseball, Ted Williams was driven by a philosophy of self-improvement across every dimension of his game. Guest blogger, Charley Ellis, reviews William’s book, The Science of Hitting, and uncovers universal insights into performance and skill that every PM and analyst can benefit from reading.

Top 10 Online Shopping Nudges

As we approach the festive season, rest assured that online retailers such as Amazon are enthusiastically waiting to help us make those important gift decisions. Here is a list of the top 10 behavioral nudges and techniques they will use to help us fill our shopping carts.

5 of the Biggest Cons in US Financial History

If you think you’re too smart to be the victim of a con artist, you’re sorely mistaken. In a nod to Dr Maria Konnikova's session on the science of 'the con' at this year's Behavioral Alpha, we present five of the US' greatest financial swindles.

Active management does have a future – and here’s what it looks like

Former PM and buy-side thought leader, Jason A. Voss, considers how the industry will evolve over the next 7-10 years, and the change that's needed to develop a new breed of successful active manager.

What do poker and investing have in common? Our 7 favorite quotes

Poker is a well-known training ground for many investors and traders. Here is a short but sweet collection of our favorite quotes on the relationship between playing a strong hand at the poker table and making a canny investment decision.

Why investing is like poker (but not chess)

Poker legend Annie Duke talks to Clare Flynn Levy about the similarities between poker and investment, and why she believes that human decision-making can hold its own against the algorithms in a world of decision-making complexity.

From Flushing Meadows to the NYSE: Why your behavioral idiosyncrasies matter

Player psychology and process has always been important important in tennis - but never more so than at this year's US Open. Guest blogger John Quartararo explores the behavioral rituals of some well-known champions and considers what investors can learn from them.

Tips for Aspiring Fund Managers

What skills and outlook are necessary for a successful career in fund management? We get some great insights and advice from a panel of experienced portfolio managers and investment specialists.

7 thought-provoking reads for the summer

For your summer reading consideration, here are our seven best ideas - packed with fascinating trends and ideas from the fields of psychology, neuroscience, behavioral science, and AI.

What investors can learn from Arsene Wenger and the beautiful game

In its adoption of science and data, football is almost unrecognisable compared to 20 years ago. Is active management next?

While you were sleeping

Interested in understanding more about the influence of sleep on your decision-making performance? We review Matthew Walker's excellent new book, Why We Sleep, with extra insights from trader coach, Denise Shull, and decision-making expert, Dr Nicholas Beecroft.

Chris Woodcock: From professional football to fintech

We talk to Chris Woodcock, Essentia's new Head of Product. He reveals his early career as a professional football player and explains why buy-side software is always better when it's built by people who have been portfolio managers themselves.

A deep dive into decision-making: Dr. Nicholas Beecroft

When investing, how often do you step back to consider the valuable information offered by your emotions and physiological state? We review a new process for professional investors that offers deeper insights into how we each invest, and proven techniques for enhanced decision-making.

Sometimes, WHEN matters more than WHAT

In his new book, 'WHEN', Daniel Pink sets out to unearth the hidden science of timing. Clare Flynn explores this engaging new read and discovers some important and surprising insights about when we should - and shouldn't - attempt to get things done.

Santa’s choice: The 7 best behavioral videos on YouTube

In a video tribute to cognitive experimentation and learning, we present seven of the best (and sometimes most amusing) YouTube videos about behavioral science.

REVEALED: What the fund manager said to the allocator

Despite a growing recognition of behavioral alpha, it's clear there are plenty of asset allocators who are still using a traditional framework to identify skilled managers. In the following email exchange, a fund manager challenges this status quo, advocating a new approach which recognises the value of combined human and data-driven decision-making.

Show me the continuous improvement

Asset allocator, Emmet Maguire III, reflects on how it's become harder to find differentiated equity strategies, and why he's now seeking out managers who can demonstrate they are tackling cognitive bias and finding ways to continuously improve their investment process.

The numbers behind the score

If you watched Wimbledon this year, you'll know that data-driven insights and analysis are fast becoming part of the tennis landscape. Guest blogger John Quartararo takes a closer look at the ways the world's best tennis players and their coaches are using technology to improve performance, and considers how it applies to the investment world.

Investment Management and AI: More partnership than takeover

Despite the hype, artificial intelligence is not yet capable of replacing human fund managers altogether. Indeed, a new categorisation of AI - augmented intelligence - is fast becoming the secret weapon of enlightened investors. We review how they're doing it.

What we’re listening to – our favorite podcasts

As podcasting comes of age, there's been an explosion in the number of high-quality broadcasts available. Listen online or download, here are 10 of the best podcasts for news & trends in technology, behavioral finance and entrepreneurship.

Can portfolio managers win from MiFID 2?

The fast-approaching MiFID 2 deadline is a welcome endpoint for many ops and compliance teams. But for those fund managers using next-generation analytics to improve performance, the recently created MiFID-driven data sets are an invaluable source of insight.

Juniorization in asset management: Are you ready?

The investment management industry has traditionally placed a lot of emphasis on time as a teacher. Will the trend towards juniorization undermine this skill base - or is this an opportunity to reinvigorate active management with new blood that's more attuned to data-driven learning?

The one thing worth doing differently this year

Acing those new year resolutions is hard - especially when you're a busy portfolio manager swamped with demands on your time. But don't give up! Clare Flynn Levy, Essentia CEO, reveals her simple, science-based tips for making the new year to come one of positive change.

Santa’s Top 10 Gifts for Behavioral Improvement

This year, give the gift of self-improvement. Here are the big man's best ideas for getting family, friends and colleagues into new and better habits.

5 easy ways to improve your process using behavioral science

Incorporating behavioral science into your investment process doesn't have to be difficult. We present five simple techniques to reinforce the scientific rigor of your investment decision-making routine.

Winning gold in fund management

The Performance Revolution of the 80's and 90's had a dramatic impact on British sport and was a major factor in the UK's Olympic success at Rio. What are the lessons for active managers in an increasingly competitive fund flow arena?

What we’re reading

By popular demand and after lots of great suggestions from you, we've updated the Essentia Recommended Reading List (one of our most downloaded white papers). Check out the additions to one of the best surveys of behavioral titles available.

Why human and machine intelligence need each other

Despite predictions to the contrary, humans are still better-equipped than computers when it comes to decision-making in complex, uncertain conditions. As a result, industries like asset management should be using technology to support its humans, not replace them.

Asset management innovation? Walk don’t run

Asset management firms have been hiring new innovation teams. But rather than adopt a head-on approach to change which may prompt resistance, we advocate a Kaizen approach that begins with smaller, measurable and more gradual improvements.

Active managers: The time is now

It's easy to postpone change - especially in a difficult market environment. But now is the time for active managers to make better use of the new technology now available to them, and level the playing field with the growing sources of competition.

“When you get clever with data, it can be truly beautiful”

We talk to Snežana Pejić PhD, Senior Quantitative Researcher at Essentia's London office. She tells us why crunching investor performance data trumps a life in academia, and how the new union between technology and behavioral science is helping people to become better investors.

Will google eat your lunch?

Speculation is increasing about Google’s ambitions in the asset management space. In this article, Eric Rovick argues that the real threat is not Google’s technology, but its culture and a willingness to focus on process and behavior. Today’s asset managers would do well to learn from this approach as more new entrants enter the market.

Before you vote in the next election…

As we approach the UK general election on May 7th, we’re looking at some of the ways in which behavioral science is being used to mobilise voters and affect their perception of the party candidates.

Applying behavioral science to your own investment decisions – Recorded webinars

In these free webinar recordings, two highly respected investment coaches talk about the everyday thoughts and reactions to be aware of as you start to factor cognitive science into your own investment activity.

On fund managers, hermit crabs and decisions under stress

How creative is your investment thinking when you're stressed? Professor Mark Fenton-O’Creevy looks at nature and scientific evidence to illustrate that we may be less flexible than we think.

Jesse Livermore and the importance of investment behavior

Jesse Livermore, the legendary investor represented in the investment classic, Reminiscences of a Stock Operator, was known for his trading and investment skill. He was also a keen advocate of self-awareness and documenting the behavioral factors that impact investment performance.

Is your email out of control?

It's been found that we spend 28 % of our time reading and responding to e-mails. If you're a fund manager you'll know it can feel like even more. Tomas Chamorro-Premuzic (on our Advisory Panel) discusses some approaches to managing emails and increasing your focus.

Managing emotions in investment decision making

Dr. Mark Fenton-O’Creevy and David Jones of IG Index show how academia and professional investing actually agree on the importance of managing your emotions in the course of investment decision making. They’re focused on trading here, but their points are no less relevant to fund managers – it’s worth a watch.