The Neil Woodford case isn’t about transparency; it’s about unchecked biases

By Clare Flynn Levy

Clare Flynn Levy is CEO & founder of Essentia Analytics. Prior to setting up Essentia, she spent 10 years as a fund manager, in both active equity (running over $1bn of pension funds for Deutsche Asset Management), and hedge (as founder and CIO of Avocet Capital Management, a specialist tech fund manager).

It’s a tale as old as time (or the last 30 years of the investment management industry, anyway): “Star” fund manager grows too fast, style starts drifting in a quest to find enough ideas, and it all ends in tears.

Neil Woodford’s story holds valuable lessons in understanding and mitigating investor biases.

Careers are ruined, investors are outraged and decision-makers are humiliated — and doing lots of finger-pointing. The Neil Woodford saga is the fallen-star story du jour, with all the usual drama. Sure, this has some modern touches, including the added zing of a hedge fund-style liquidity crisis. But none of it is unprecedented.

Before I continue, I want to say that neither Essentia nor I has ever worked with Woodford or his data to run any sort of behavioral or performance analytics. Yet word on the street in the UK fund management industry for several years now was that he was deviating from a traditional equity income mandate (which is focused on delivering a combination of dividends and capital gains); so the new revelations are not a surprise.

Dotting the i’s

How did this drift get so extreme — and so destructive? The investors who allocated the largest pots of capital to Woodford undoubtedly had access to analysis of his performance and risk-taking – including traditional attribution analysis that reversed out where his performance (or underperformance) had come from, and what sorts of risk exposures he had borne in getting there. For large allocators, this stuff is “table stakes”.

But this crisis shows us that table-stakes analytics are not enough. That basic analysis would have shown his style drifting as his assets grew. What it wouldn’t have shown is the story-telling, biases, and incentive structures that enabled investors (and, quite possibly, Woodford himself) to ignore the data for so long.

The allocators of capital to Woodford knew (or will know, when they one day look back on this situation) that questions were being asked several years before they decided to pull the ripcord on their investments with Woodford. So why didn’t they do it sooner?

Bias pudding

The financial incentives of wealth managers and investment product producers will likely prove to have been a contributing factor, as some have observed, but these companies’ motivations are actually more nuanced and less calculated than the cynics from outside the industry might assume. I think it’s pretty clear that the inaction pervading the Woodford situation was largely due to something else: there was an enormous amount of behavioral bias baked into this particular pudding.

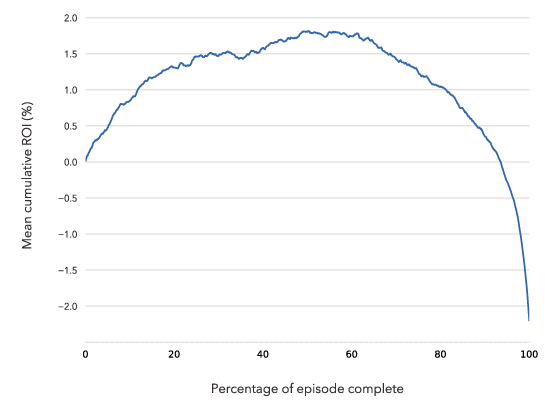

In our last post, Essentia Head of Research Chris Woodcock talked about the lifecycle of alpha generation within equity portfolios. We found that managers fell into four different alpha lifecycle “profiles”:

- The Linear Accumulator, whose alpha generation was slow and steady throughout the life of the average position;

- The Coaster, whose alpha generation tended to peak relatively early in the life of a position, then peter out for the latter half;

- The Hopeless Romantic, who generates big alpha in the early days of a position, then gives it up and more in the weeks that follow; and

- The Round Tripper, who generates alpha steadily, and then steadily gives it back.

Why a given manager’s ideas tend to run out of alpha after a certain point is a function of a lot of different factors, including AUM growth. As hedge fund investors well know, it’s hard to keep generating alpha, even in a liquid strategy, beyond a certain AUM level.

But alpha decay happens even when AUM is small and portfolios are liquid. As any investor who has experienced a “round trip” before can attest, when a company has made us money, we give the management team more benefit of the doubt than we give it when we’re losing money. How large or illiquid our position is doesn’t necessarily change that.

The Round Tripper: This common alpha lifecycle profile vividly illustrates the impact of holding on to a position for too long. (View all alpha lifecycle profiles).

We associate this round-tripping behavior with the endowment effect – the tendency to overvalue something just because you own it. But in practical terms, those allocators who had made money with Woodford over many years will know, deep down, that, in recent years, they were less disciplined in implementing their investment process with his fund than they (hopefully) were with other funds. They are humans and that behavior is natural. But it’s also expensive.

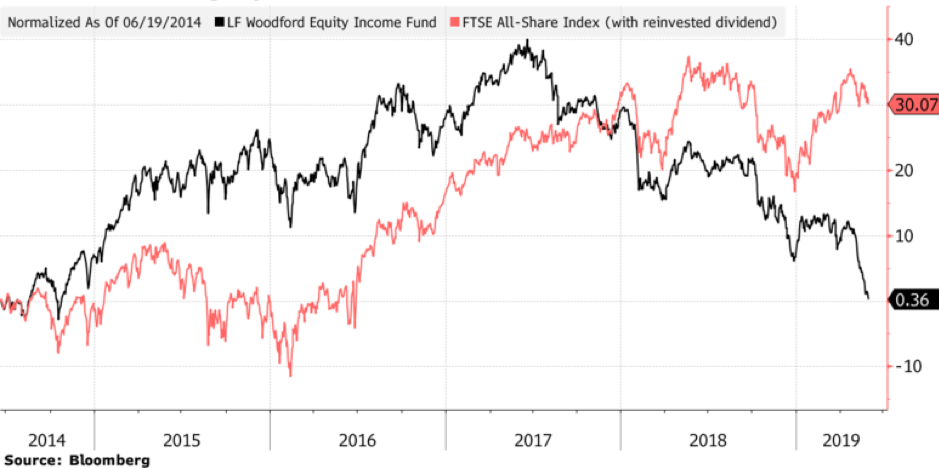

For anyone who got in at the start of Woodford Equity Income, it’s been a Round Tripper – it has given up nearly every penny it has made since launch (and then some, when compared with the benchmark).

Know your bias risk – and control for it

So what could both Woodford and his investors could have done differently? Lots of things, in retrospect. The single most important thing that they can do, going forward, is acknowledge that they are affected by judgement-clouding behavioral biases just like everyone else, and that in order to make the best possible decisions for their investors, they must build more bias-mitigating discipline into their own investment processes.

What we know at Essentia is that once you’ve recognized the bias in your own behavior, it is possible to improve, not by remembering it the next time you make a decision (which, let’s face it, doesn’t actually work), but by using technology to keep track, in the background, of what’s going on in your portfolio and to “nudge” you to revisit your hypothesis, in a structured way, at crucial decision-making points.

On the back of the Woodford situation, the call for increased transparency is louder than ever. But I’d posit that transparency isn’t really the issue here – after all, we’re talking about a mutual fund that was covered by all the major investment consultants and wealth management platforms in the UK. More data wouldn’t necessarily have made a difference.

What would have helped, both Woodford and the people who allocated capital to him, was investor (or even regulatory) demand for proof of a consistent and disciplined investment process. In meeting that demand, everyone involved would have seen their own behavior more clearly, and made better decisions on behalf of end-investors.