January 31, 2025: Morningstar and Essentia Analytics announce strategic alliance. Read more

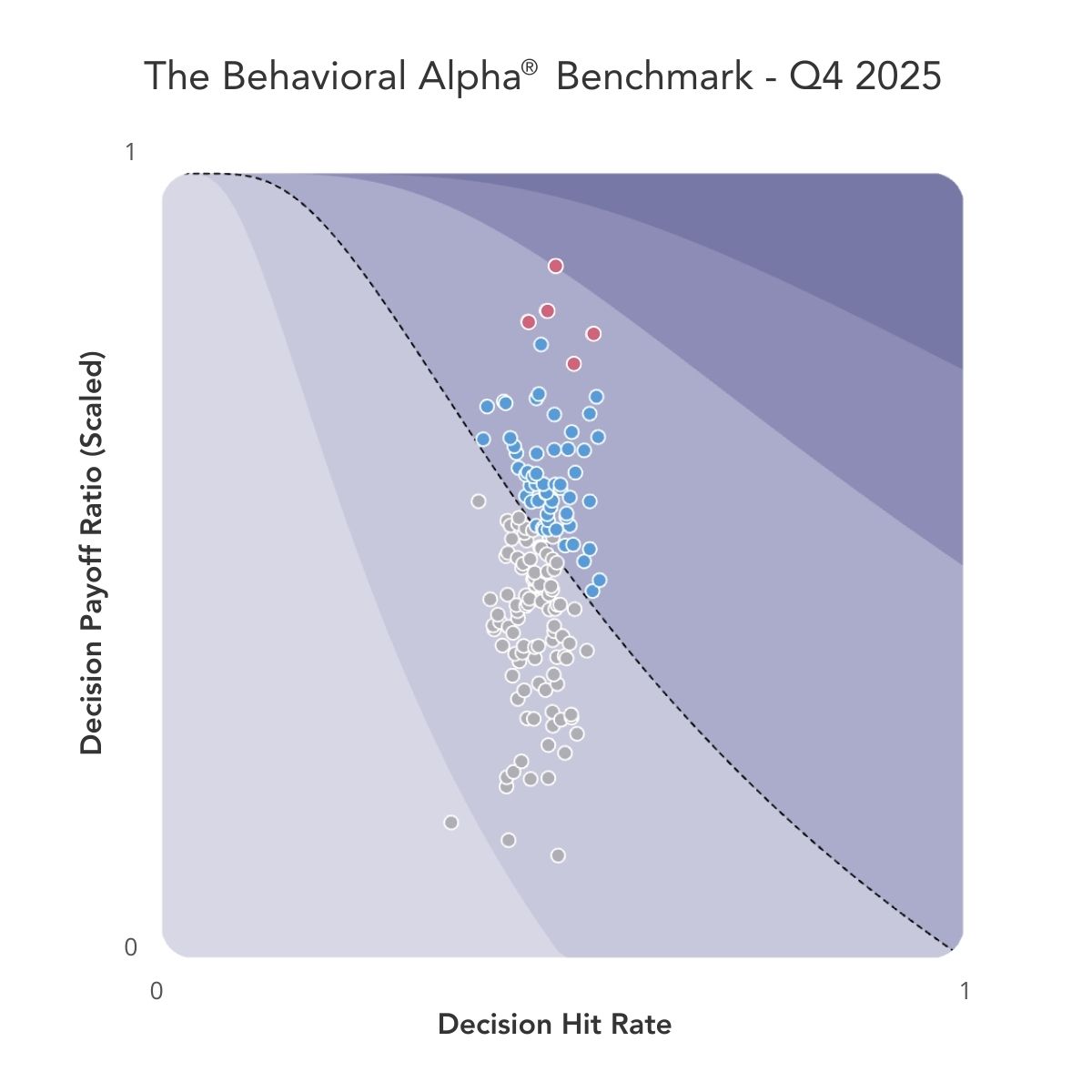

Delivering Behavioral Alpha®

Essentia helps both short and long-term professional investors mitigate bias, maintain investment discipline and achieve better performance.

Who uses Essentia

Essentia provides behavioral analytics and performance consulting services on assets totaling more than $430 billion.

Proven ROI

Our analytical tools, data-driven consulting, and proactive nudges helped one senior equity manager to increase alpha and deliver a 435% return on his Essentia investment.

Institutional Investor covers Essentia’s latest research, which finds a statistically significant link between past decision-making skill and future investment returns.

Investment consultant Evan Frazier and seasoned manager selector Joe Wiggins join Essentia’s webinar series to share their favorite manager selection questions — and answers.

Essentia CEO Clare Flynn Levy explains the problem with traditional performance attribution (vs. decision attribution) in a seminar with the Portfolio Construction Forum.

Learn about Northern Trust’s (NTRS) strategic investment in Essentia Analytics.

Read the press release

The Future of Active Management

Essentia is transforming the way that professional investors measure, demonstrate and continuously improve investment performance.

Award-Winning Investment Analytics

Our software and services are designed by investment professionals working in collaboration with a team of world-class technologists and behavioral scientists.

Your Data Security is Our Priority

Using Amazon’s AWS cloud infrastructure, we structure our clients’ data within a high security, purpose-built architecture that has passed the industry’s most rigorous information security audits. It’s one more reason why some of the world’s largest fund management firms trust Essentia with their most sensitive information.