As decision-making scores extend a multi-quarter decline, skilled managers continue to stand out for their consistent performance.

Our latest (three years ended March 31, 2025) Essentia Behavioral Alpha Benchmark ranking shows a sustained decline in median Behavioral Alpha Scores and the repeat appearance of Silvercrest International Small Cap Value as our top-ranked manager. As always, the ranking focuses on decision-making skill, rather than past returns, offering a unique insight into how managers are navigating market dynamics.

About the Behavioral Alpha Benchmark

The Essentia Behavioral Alpha Benchmark (EBAB) is the industry’s only systematic assessment of investment decision-making skill. Unlike traditional rankings based on past returns, EBAB evaluates how portfolio managers make investment decisions over a 36-month period, isolating skill from luck and market movements.

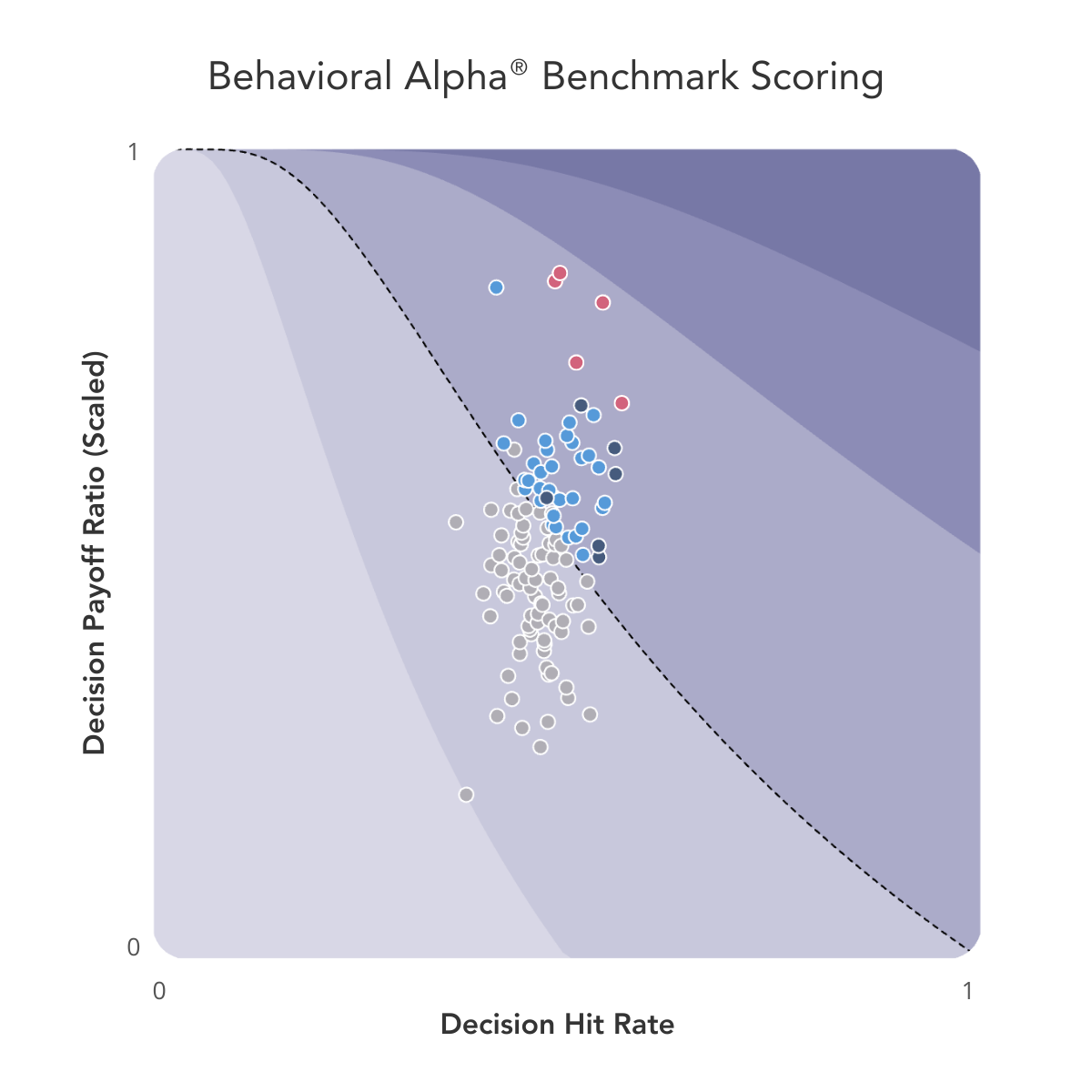

Using proprietary decision attribution analytics, the ranking assesses managers across seven key decision types. A manager’s Behavioral Alpha Score (BA Score) is calculated based on their hit rate (percentage of decisions that add value) and payoff ratio (the magnitude of good vs. bad decisions). A Behavioral Alpha Score above 50 indicates consistent value-additive decision-making.

The most recent 36-month assessment concluded on March 31, 2025, evaluating the demonstrated decision-making skill of 125 active equity mutual fund and investment trust portfolio managers using the Behavioral Alpha Score. The Top 5 managers are as follows:

| Rank | Manager(s) | Portfolio (Benchmark) |

| 1 | Robert Choi Al Chan Chris Richey Kevin Hill Ron Dornau |

Silvercrest International Small Cap Value Fund |

| 2 | Sukumar Rajah |

Franklin India Fund |

| 3 | Charles Bond Matt Pigott |

Invesco Global Emerging Markets Fund (UK) |

| 4 | Rakesh Bordia Caroline Cai Allison Fisch John P. Goetz |

Pzena International Value Fund |

| 5 | David Schuster | Brown Advisory Small-Cap Fundamental Value Fund |

Key Takeaways and Notable Trends from the Q1 2025 36-month assessment:

- Silvercrest maintains the top spot. Silvercrest International Small Cap Value maintains the top spot in our ranking for the second consecutive quarter, with a BA Score of 72.2.

- Median Behavioral Alpha Scores declined again. The median BA Score fell to 47.8 in Q1 2025 — the fourth consecutive quarterly decline.

- Hit rates declined across the board. Only 22.1% of managers had overall hit rates above 50%, down from 31.7% in the prior period — indicating fewer value-added decisions.

- Entry timing improved. One of the few bright spots this quarter was a general improvement in entry timing decisions, which suggests managers are gaining skill in initiating positions during favorable conditions.

- Size adjusting declined across the board. This decision type showed notable deterioration, raising concerns around how effectively managers are responding to developments in existing positions.

- Top performer consistency continues, reflecting the persistence of decision-making skill (see our research on this phenomenon). Four of this quarter’s Top 5 managers have appeared in previous rankings, and three return from last quarter’s Top 5 — reaffirming the persistence of decision-making skill over time.

These results are publicly available through Essentia Insight’s Behavioral Alpha Benchmark app, which provides access to all mutual funds, active ETFs and SMAs in the Benchmark database. And, with our new Insight Pro tier, you can drill down on a portfolio’s Behavioral Alpha Score for deeper visibility into which decision types have been adding and destroying the most value.

How the BA Score is Calculated

The Behavioral Alpha Score (BA Score) is determined using a systematic approach that evaluates investment decision-making skill over a 36-month period. The methodology isolates skill from market conditions by analyzing managers’ hit rates (the percentage of value-added decisions) and payoff ratios (the relative impact of good versus bad decisions).

Each manager’s score is benchmark-adjusted and calculated based on seven key decision types:

- Stock selection – Did the manager choose stocks that outperformed relative to their benchmark?

- Entry timing – Did the manager add value through the precise timing of their entry?

- Sizing – Did the manager add value through sizing decisions, compared to running an equally-weighted portfolio?

- Scaling in – Did the manager add value through the way they scaled into their positions, or would a basic algorithm have done just as well?

- Size adjusting – Did the manager make beneficial mid-position adjustments?

- Scaling out – Did the manager add value through the way they scaled out of their positions, or would a basic algorithm have done just as well?

- Exit timing – Did the manager add value through the precise timing of their exit?

To participate in the Benchmark ranking/awards or use the methodology for manager assessment, click here to get started with the Behavioral Alpha Benchmark app.

To contact us, please complete the form below.