By Professor Mark Fenton-O’Creevy

Share post

Foreword by Clare Flynn Levy

There isn’t a fund manager alive who wouldn’t list “clear thinking under pressure” as a key requirement for the job.

Flexibility of mind is essential in a continuously tense market environment in which rapid change is the norm and anxious companies are constantly pivoting to avoid the threat of disruption or disintermediation. Active fund managers themselves face an intensifying competitive landscape, given the steady flow of assets to passive investment vehicles.

In these stressful times, the ability – and the guts – to do things differently has never been more important.

Yet cognitive research shows that when under real pressure, like all humans, we are actually more likely to revert to habit – we stay with the ideas or routines that we know, and which feel safe. We ‘go in to our shells’. As a result, we’re less likely to consider new tactics or processes which, whilst uncomfortably unfamiliar at first, may be exactly what’s needed.

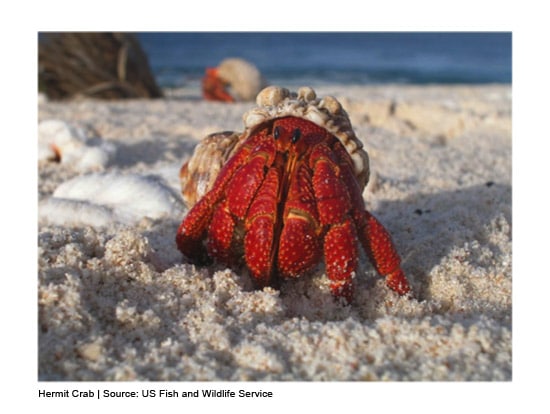

In the short article below, Prof. Mark Fenton-O’Creevy illustrates that this reaction to environmental stress is common across many different species, including the opportunistic hermit crab, and looks at what we can do to counteract the tendency to fall back on habit.

In stressful times like these, “the herd” is driven by its nature to hide behind old processes, habits and ideas. But as all fund managers know, one doesn’t make money by being part of the herd.

On fund managers, rats and hermit crabs: reversion to familiar habits under stress

Professor Mark Fenton-O’Creevy

Hermit crabs rely on acquiring discarded shells for their protection and are constantly on the look-out for better shells. However, faced with environmental stress they prefer to stick with their old shell, however unsuitable, than risk moving to a new one [i].

Experiments with rats show that under stress habitual behaviour persists longer in the face of changed reward structures – the market conditions may have changed but stressed rats take long to spot this than unstressed ones. In stressful conditions the more rigid ‘habit’ memory system is favoured over the more flexible ‘cognitive’ memory [ii].

As we learn more about the neuroscience of decision-making, cross-species research is starting to help us understand more about how humans think and decide. In our daily lives and at work we are faced with the need to navigate complex situations with limited cognitive resources. A major strategy that evolution has equipped us with (just like hermit crabs and rats) is the development of habitual responses. These can be quite complex behaviours. For example the first couple of journeys driving to a new workplace can involve a good deal of route-finding and thinking things through to achieve the goal of arriving at your intended destination. After sufficient repetition the journey becomes a habit. There has been a shift from goal directed cognition to habitual behaviour.

Habitual responses have value because they free us to devote cognitive resources to what is novel or challenging. However, they are also rigid and inherently less adaptable to changing conditions. Just like rats and hermit crabs, there is evidence that humans fall back on rigid habits when stressed and become less able to respond flexibly to environmental signals [iii].

There is increasing evidence that this stress response can be an important factor in financial markets. For example, in one study of investment bank traders, we used a physiological measure (heart-rate variability) of moment by moment flexible responding to environmental signals. The traders’ ability to respond flexibly was significantly impaired in volatile market conditions [iv].

So, just at the point where fund managers need to be at their creative best, the natural inclination may be to freeze into habitual behaviour patterns. What can be done to counter this?

As with most aspects of human behaviour, simply being aware of a behavioural tendency is not sufficient to eliminate it. If this were true, diets would be easy. The human capacity for self-regulation is useful but soon becomes exhausted. What can help is a dual approach combining systems that aid regular self-monitoring and reflection alongside lifestyle approaches which help reduce the impact of stress.

__________

[i] De la Haye, K. L., Spicer, J. I., Widdicombe, S., & Briffa, M. (2011). Reduced sea water pH disrupts resource assessment and decision making in the hermit crab Pagurus bernhardus. Animal Behaviour, 82(3), 495-501.

[ii] Koot, S., Baars, A., Hesseling, P., van den Bos, R., & Joëls, M. (2013). Time-dependent effects of corticosterone on reward-based decision-making in a rodent model of the Iowa Gambling Task. Neuropharmacology, 70, 306-315.

Dias-Ferreira, E., Sousa, J. C., Melo, I., Morgado, P., Mesquita, A. R., Cerqueira, J. J., … & Sousa, N. (2009). Chronic stress causes frontostriatal reorganization and affects decision-making. Science (New York, NY),325(5940), 621.

[iii] Schwabe, L., Wolf, O. T., & Oitzl, M. S. (2010). Memory formation under stress: quantity and quality. Neuroscience & Biobehavioral Reviews, 34(4), 584-591.

[iv] Fenton-O’Creevy, M., Lins, J., Vohra, S., Richards, D., Davies, G., & Schaaff, K. (2012). Emotion regulation and trader expertise: heart rate variability on the trading floor. Journal of Neuroscience, Psychology and Economics, 5(4), 227-237.